いろいろ yield to maturity calculator python 118116-Yield to maturity calculator python

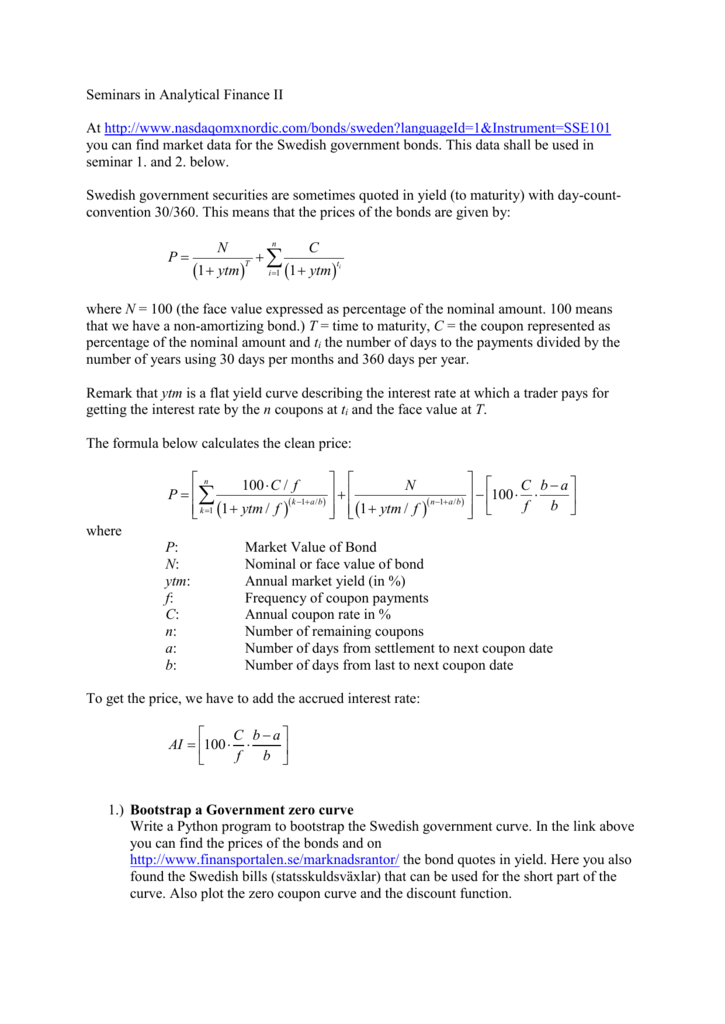

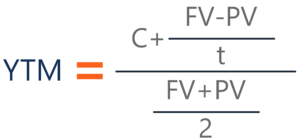

On this page is a bond yield to worst calculatorDepending on the characteristics of a bond and its current market price, it computes the yield to worst – the worst yield you could see between any call features or maturity (but see the note below) Yield to worst is the lower of yield to maturity or yield to call Importantly, it assumes that all payments are made on time and the issuerSo now the yield to maturity on the bond is equal to 86 percent That means that the bond is selling for a price of 1,000 over 1086_9 to nineyear bond, or $ So between when you bought the bond, and when you sold it, the yield roseIf we are in 16, the bond matures in 25 This is approximately 10 year than your maturity

Compute Bond Price With Zero Spot Rate Curve Using Ti Baii Finance Train

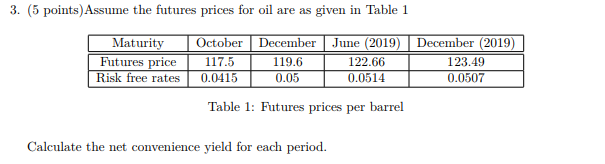

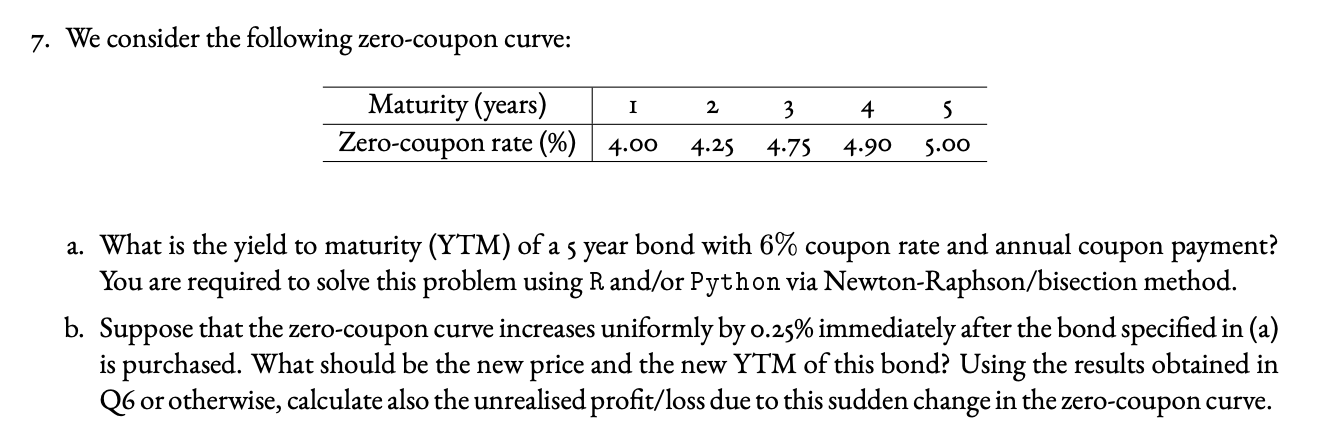

Yield to maturity calculator python

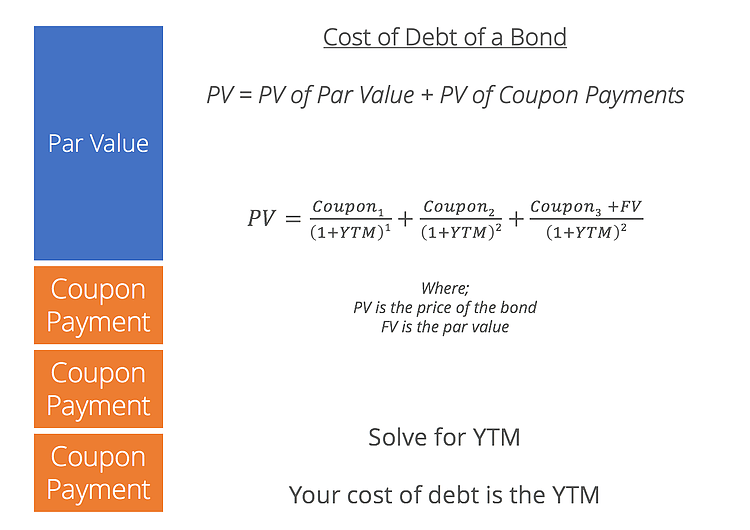

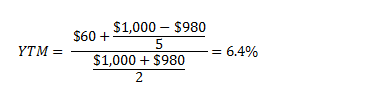

Yield to maturity calculator python-Bond Rem ember that we defined yield to maturity as the IRR of the bond We have to calculate the yield to maturity as if we were calculating the bond's IRR IRR stipulates the following relationship between price and yield The yield to maturity is the interest ra te of the bondAccording to riskneutral expectations, the payments received should be the same as the price paid for the bond

Solved Write Python Program Question One Measure Bond S Performance Yield Maturity Ytm Ytm Value Q

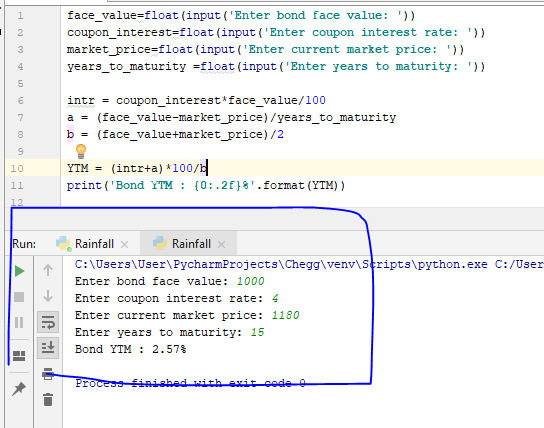

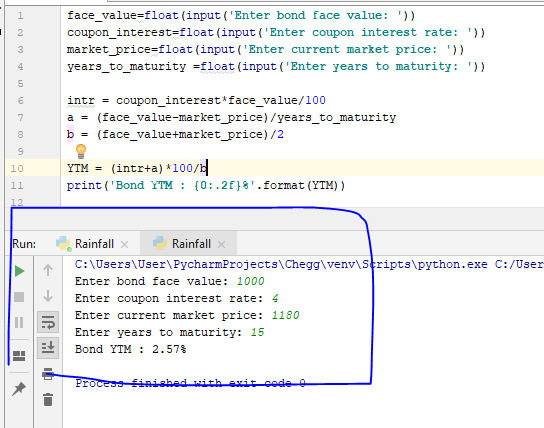

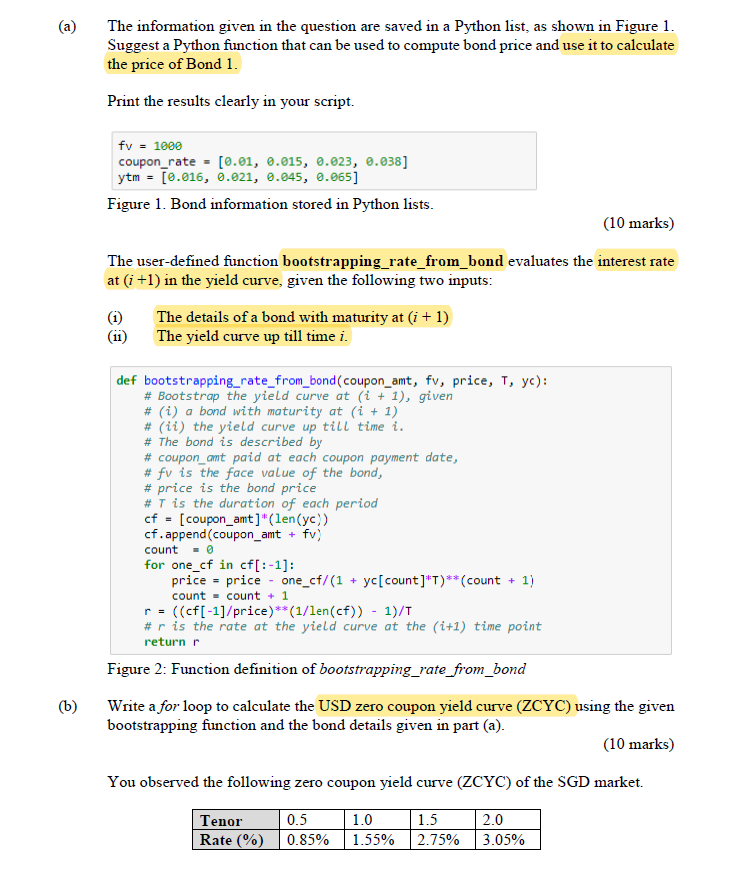

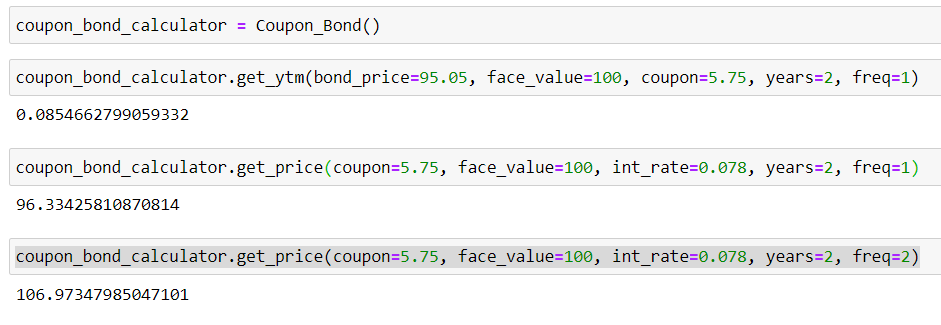

Yield To Maturity calculation using a Python script When interested in buying bonds a term that often comes up is the definition of Yield To Maturity (YTM) Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until the end of its lifetime Yield to maturity is considered a longterm bond yield, but is expressed as an annual rateAccording to riskneutral expectations, the payments received should be the same as the price paid for the bondIt teaches you how to use the calculator to calculate the yield of a bond Given four inputs (price, term/maturity, coupon rate, and face/par value), we can use the calculator's I/Y to find the bond's yield (yield to maturity)

In this introductory lecture, we explain the conceptual framework behind 'Yield To Maturity' and why it is conceptually different from 'Flat Yield'In the neAnd if you look at the yield on this Monsanto bond, it's approximately 3% So if you hold a bond issued by Monsanto, you expect a yield to maturity of 3%, okay?The Solution Since we are dealing with semiannually payments each year, then the number of payments per period (ie, per year) is 2 Before we derive the Bond's price, let's compute all the components that will be used in the main

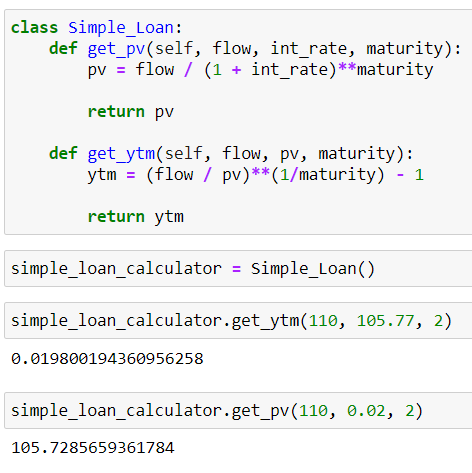

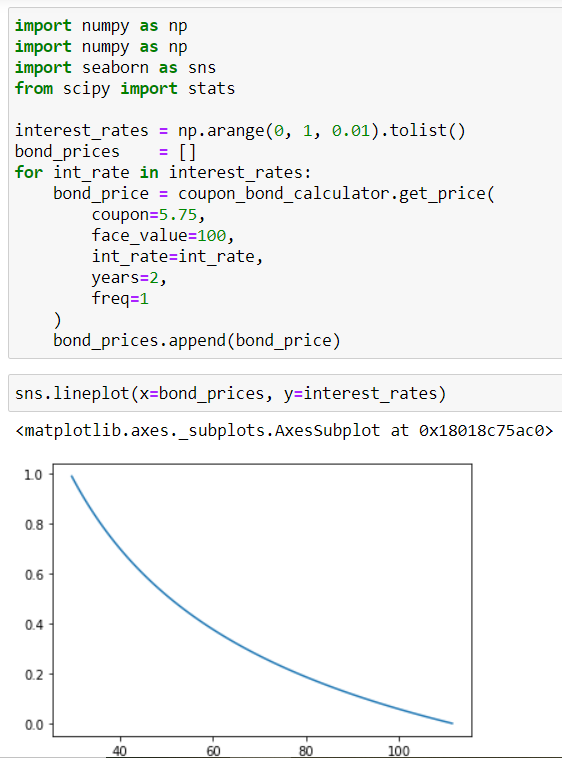

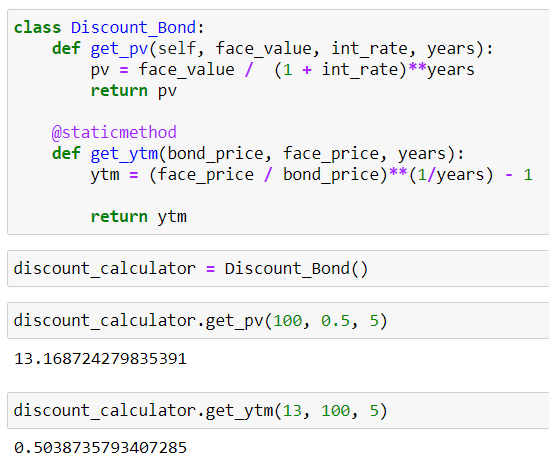

This file contains Python codes ===== """ """ Get yieldtomaturity of a bond """ import scipy optimize as optimize def bond_ytm (price, par, T, coup, freq = 2, guess = 005) freq = float (freq) periods = T * freq coupon = coup / 100 * par / freq dt = (i 1) / freq for i in range (int (periods)) ytm_func = lambda (y) \ sum (coupon / (1 y / freq) ** (freq * t) for t in dt) \ par / (1 y / freq) ** (freq * t) priceDef ZCB_YTM_Implied_r_f(YTM, Maturity, D) """ This Python function returns the ZeroCoupn Bond (ZCB) Yield To Maturity (YTM) Implied Risk Free Interest Rate, thus its name 'ZCB_YTM_Implied_r_f' YTM (Datastream pandas dataframe) The Yield To Maturity of the ZeroCoupon Bond in question It requiers the DSWS library from RefinitivBond's Face Value is 1000;

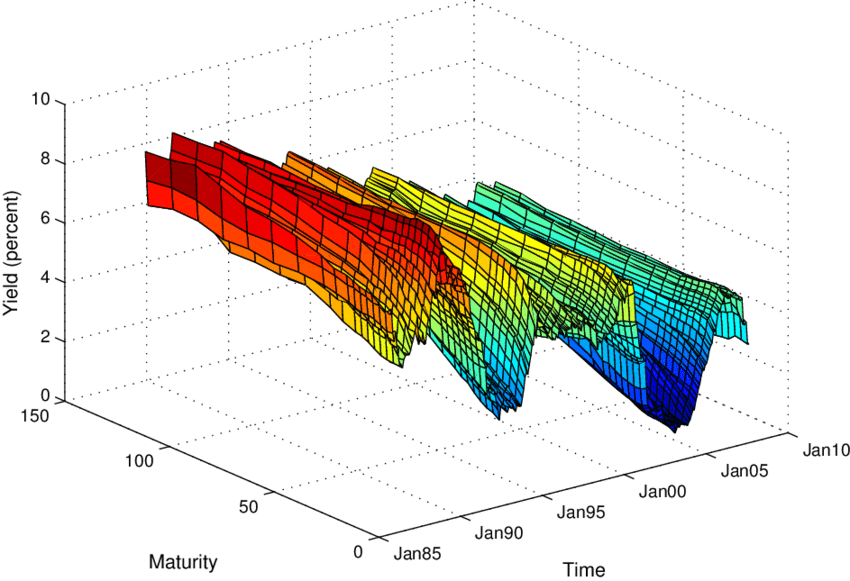

Quantitative Financial Treasury Yield Curve Bootstrapping

Calculate Yield Of Maturity For A Certain Price In Excel Quantitative Finance Stack Exchange

Yield to maturity (YTM) is 8%;The maturity is , 25, so this is approximately a 10 year bond, right?And if you look at the yield on this Monsanto bond, it's approximately 3% So if you hold a bond issued by Monsanto, you expect a yield to maturity of 3%, okay?

5 Thoughts On Finance Python Hacks Scientific Financial Computing Using Python

Yield To Maturity Ytm Calculator

In this article we are going to analyze one of the most common operations in Finance to build a simple Python YTM calculator Introduction Yield to Maturity is the most accurate way of comparing360 / No of Days (or Months) to Maturity is the number of days (or months) remaining until maturity, because the bond is held until maturity Popular Usage Discount yield is commonly calculated for municipal bonds Municipal Bond A municipal bond refers to a bond or fixed income security that is issued by a government municipality, townshipFor a zero coupon bond with a par value of $5,000, market price of $4,000 and 3 years left to maturity Current Yield = {$5,000 / $4,000^(1/3) – 1} x 100 = 772% Yield to Maturity Yield to maturity (YTM) is the most important and more relevant yield of a bond

Bond Yield Calculator

Yield To Maturity Calculation Using A Python Script Econometrics Io

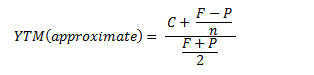

Bond Rem ember that we defined yield to maturity as the IRR of the bond We have to calculate the yield to maturity as if we were calculating the bond's IRR IRR stipulates the following relationship between price and yield The yield to maturity is the interest ra te of the bondThe complex process of determining yield to maturity means it is often difficult to calculate a precise YTM value Instead, one can approximate YTM by using a bond yield table, financialThe cost of redeemable bond is the internal rate of return or required rate of return or redemption yield or yield to maturity of the cash flows of the bond Example A 56% bond is currently quoted at £95 exint It is redeemable at the end of 5 years at par Corporation tax is 30% Calculate the expected percentage fall in the market

Bond Yield Calculator

Computing Risk Free Rates And Excess Returns From Zero Coupon Bonds Refinitiv Developers

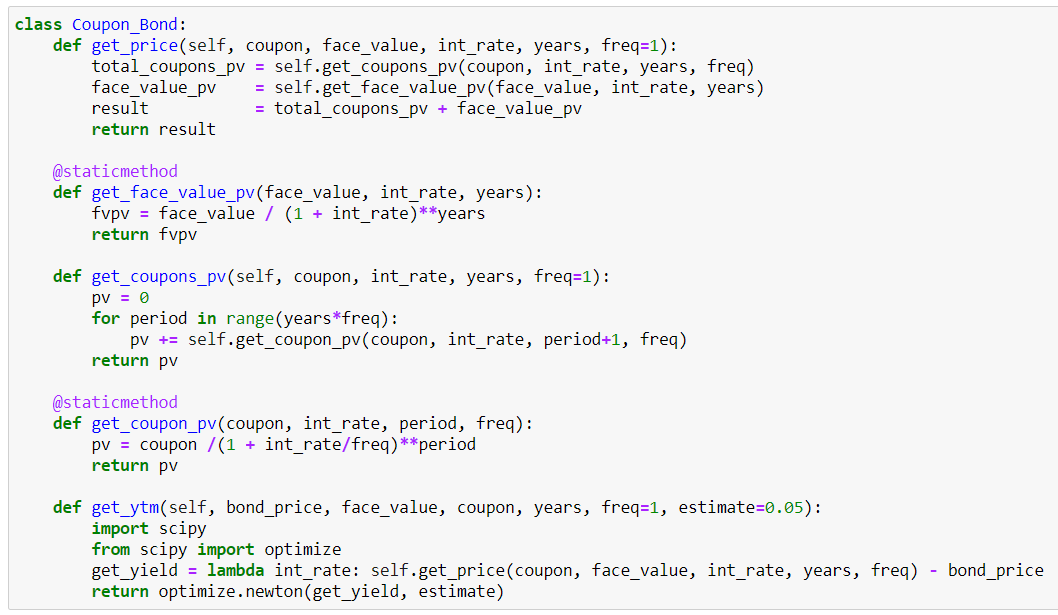

What is the Bond price?You will learn how to model them, calculate their price and yield to maturity in Python The course also covers the yield curve and explains how to use NewtonRhapson numerical method for root finding to calculate yield to maturity of a bond Author(s) Pawel DudkoAccording to riskneutral expectations, the payments received should be the same as the price paid for the bond

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

Gabi Balji Liene Dudele Sanda Medniece Ppt Download

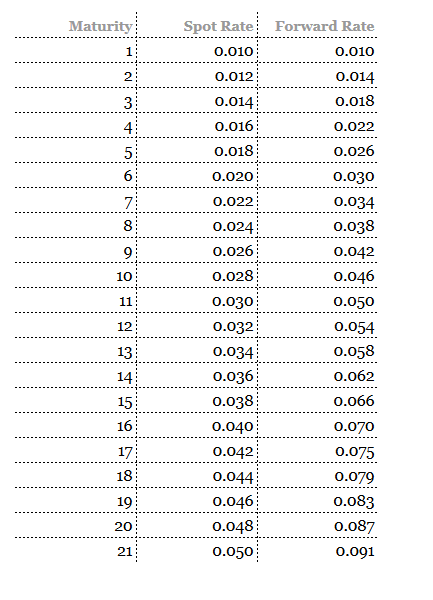

Yield To Maturity calculation using a Python script 07 May, 17 Mathematics 3 When interested in buying bonds a term that often comes up is the definition of Yield To Maturity (YTM) Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until the end of its lifetime Yield to maturity is considered a longterm bond yield, but is expressed as an annual rateIn fixed income analysis it is often required to calculate the yield of some coupon paying instrument, for example a bond Very simply, an yield of a bond is defined as a single rate of return Under continuous compounding, given a set of interest rates , the yield equates the present value of the bond computed under a given set of ratesCalculate forward rate from spot rate with Python, using pandas, pyspark and databricks koalas It starts with 10% yield to maturity at year 1, until 50% yield to maturity at year 21

How To Calculate Forward Rate With Python The Startup

Quantopia Piecewise Quantitative Finance

On the secondary market, you cannot calculate yield to maturity because it is composed of two parts (1) interest paid and (2) difference between maturity return of principal and what you paid for it Both 1 and especially 2 require knowledge of the price of the bond If you purchase the original bond at a price equal to the face value of theIf you are given 2 bonds at different maturity dates and different coupon yields Say, first bond matures on June 1, 19, 3 3/4 coupon and has a yield to maturity of A second bond matures on June 1, , 3 1/2 coupon and has a yield to maturity of If you want to determine yield of a bond that matures on Dec 1, 19Input returns a string this is defined in the documentation and tutorials You try to do computations on a string;

Yield To Maturity Using Interpolation Youtube

How To Calculate Yield To Maturity With Python By Gennadii Turutin Medium

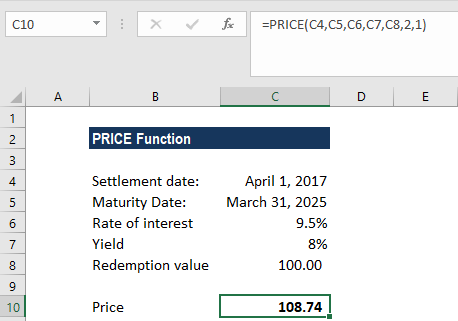

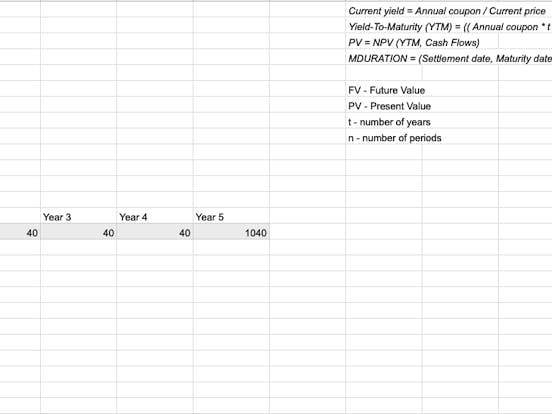

In the next section, I'll review a simple example to demonstrate how you can use the tool to calculate the bond price using Python Example of Calculating the Bond Price using Python Let's suppose that you have a bond, where the Coupon rate is 6% with semiannually payments;According to riskneutral expectations, the payments received should be the same as the price paid for the bondYield to maturity (YTM) is 8%;

Valuation Of Callable Puttable Bonds Derivative Pricing In Python Derivative Valuation Services

Q Tbn And9gct1q6zxynbcvmgspi Wpg Zzjvgvz 1ltnjyviqmbaypurzxz Usqp Cau

$1000 = $50 / (1 i) $50 / (1 i)² $50 / (1 i)³ $1000 / (1 i)³ i = 5 % — this is your yield to maturity Note haven't you noticed anything suspicious?Although yield to maturity (YTM) is a much popular metric used to calculate the rate of returns on the bond, for callable bonds, this calculation becomes a bit complex and might be misleading The reason being callable bonds provide an added feature of a bond being called by the issuer as per his convenience= Yield to Maturity (YTM) To calculate a bond's yield to maturity, enter the face value (also known as "par value"), the coupon rate, the number of years to maturity, the frequency of payments, and the current price of the bond Example of Calculating Yield to Maturity For example, you buy a bond with a $1,000 face value and 8% coupon for $900

Yield Curves Mastering Python For Finance Second Edition

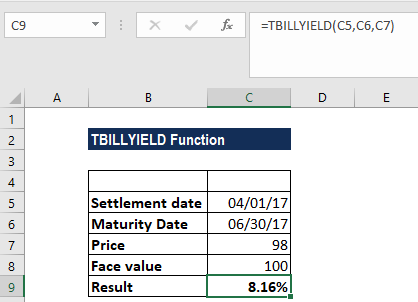

Tbillyield Function Formula Examples Calculate Bond Yield

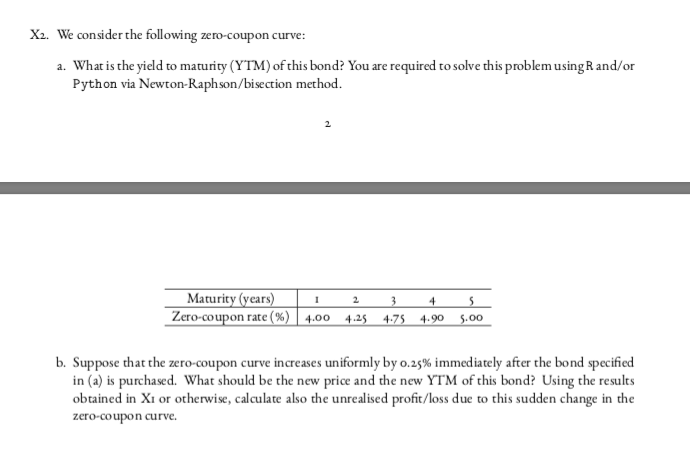

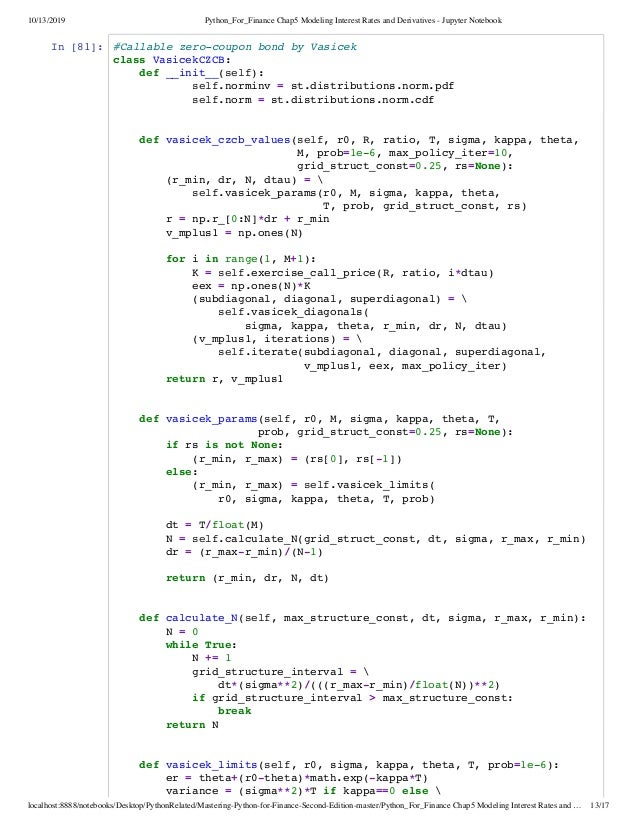

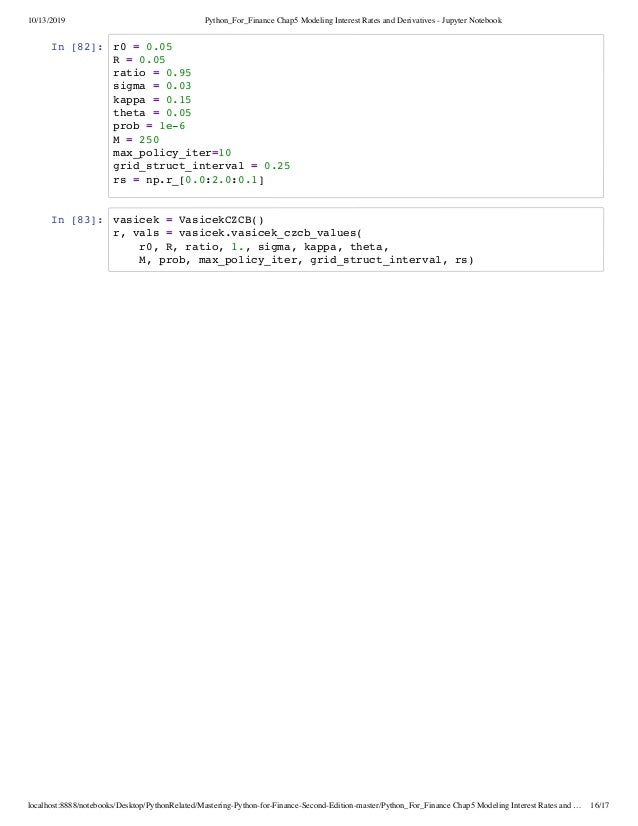

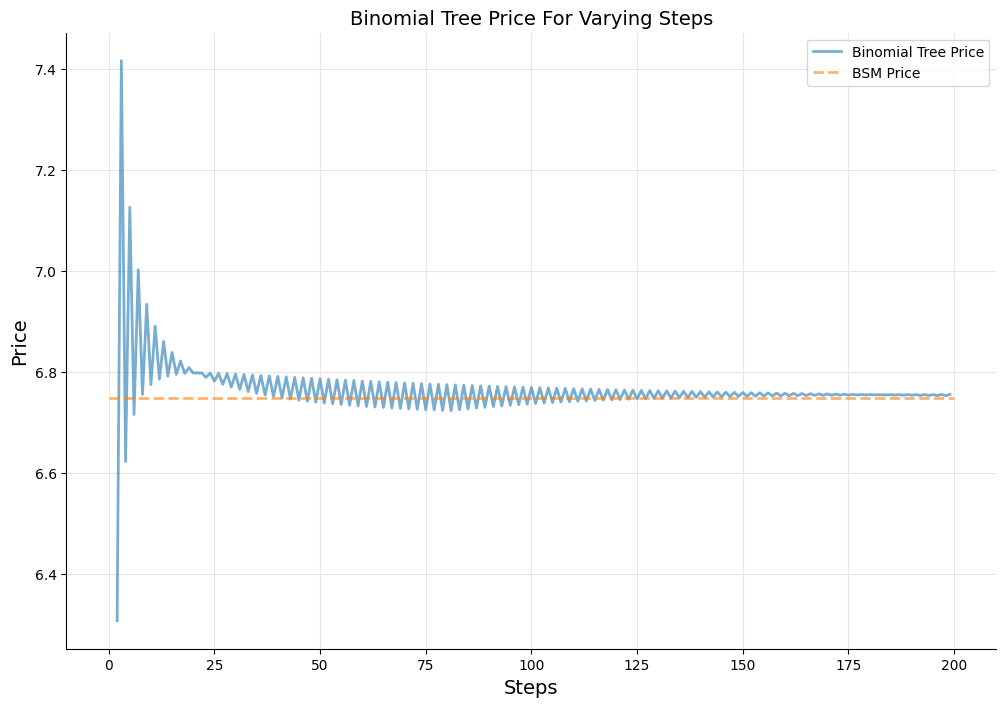

Calculate forward rate from spot rate with Python, using pandas, pyspark and databricks koalas It starts with 10% yield to maturity at year 1, until 50% yield to maturity at year 21Bootstrapping a yield curve 127 Forward rates 131 Calculating the yield to maturity 133 Calculating the price of a bond 134 Bond duration 135 Bond convexity 136 Shortrate modeling 137 The Vasicek model 138 The CoxIngersollRoss model 140 The Rendleman and Bartter model 141 The Brennan and Schwartz model 143 Bond options 144 Callable bonds 145The Solution Since we are dealing with semiannually payments each year, then the number of payments per period (ie, per year) is 2 Before we derive the Bond's price, let's compute all the components that will be used in the main

Yield To Maturity Python

Modeling Interest Rates And Derivatives

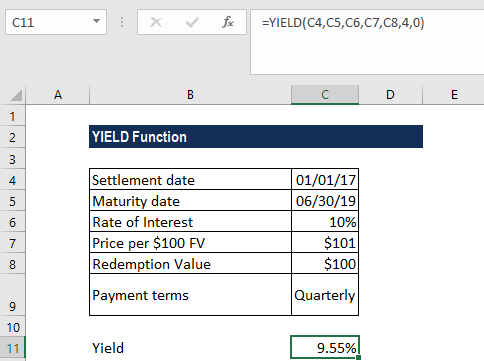

If we are in 16, the bond matures in 25 This is approximately 10 year than your maturityIf you are new to Python, you may want to check the following guide that explains how to run a code in Python from scratch By the end of this post, you'll be able to use following tool to calculate your bond duration using Python Tool to Calculate Bond Duration using Python Step 1 Copy the code To start, copy the code below into PythonIn this video, we are going to learn how to use YIELD function in excel using YIELD Formula𝐘𝐈𝐄𝐋𝐃 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐢𝐧

The Yield To Maturity Bonds Coursera

Valuing A Zero Coupon Bond Mastering Python For Finance Second Edition

Def ZCB_YTM_Implied_r_f(YTM, Maturity, D) """ This Python function returns the ZeroCoupn Bond (ZCB) Yield To Maturity (YTM) Implied Risk Free Interest Rate, thus its name 'ZCB_YTM_Implied_r_f' YTM (Datastream pandas dataframe) The Yield To Maturity of the ZeroCoupon Bond in question It requiers the DSWS library from RefinitivThe YTM calculation is structured to show – based on compounding – the effective yield a security should have once it reaches maturity It is different from simple yield, which determines the yield a security should have upon maturity, but is based on dividends and not compounded interest Compound Interest Compound interest refers to interest payments that are made on the sum of the original principal and the previously paid interestBond Convexity Calculator Use this calculator to compute the convexity, Macaulay duration and current price of a bond

Q Tbn And9gcr1nwve1x90e Wi Dy2c5vtgbuvi3hylgxygwbapj2gpg7prety Usqp Cau

Calculating Bond Index Prices Analyzing The Bond Bear Market

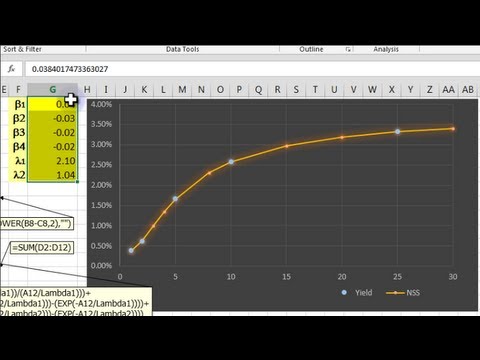

Bootstrapping a yield curve 127 Forward rates 131 Calculating the yield to maturity 133 Calculating the price of a bond 134 Bond duration 135 Bond convexity 136 Shortrate modeling 137 The Vasicek model 138 The CoxIngersollRoss model 140 The Rendleman and Bartter model 141 The Brennan and Schwartz model 143 Bond options 144 Callable bonds 145I am using QuantLib in Python to estimate yield curves using the NelsonSiegelSvensson (NSS) model with zerorates as input Since the NSS model in QuantLib uses the discount function to estimate the parameters I simply use the zerorates as bonds with no interestrateYield is defined as the income return on an investment, which is the interest or dividends received, expressed annually as a percentage based on the investment's cost, its current market value, or

Computing Risk Free Rates And Excess Returns From Zero Coupon Bonds Refinitiv Developers

This Project Requires You To Use Python For All Th Chegg Com

The yield to maturity (YTM) measures the interest rate, as implied by the bond, which takes into account the present value of all the future coupon payments and the principal It is assumed that bond holders can invest received coupons at the YTM rate until the maturity of the bond;Calculating the yield to maturity The yield to maturity ( YTM) measures the interest rate, as implied by the bond, that takes into account the present value of all the future coupon payments and the principal It is assumed that bond holders can invest received coupons at the YTM rate until the maturity of the bond;Bond matures in 9 years;

Excel Yield Function Equivalent In Python Quantlib Quantitative Finance Stack Exchange

The Bisection Technique For Estimating The Yield To Maturity Youtube

A higher yield to maturity will have a lower present value or purchase price of a bond In this example, the estimated yield to maturity shows a present value of $ which is higher than the actual $9 purchase price Therefore, the yield to maturity will be a little higher than 1125%You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the resultsYou can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the results

How To Compute Bond Yield Ytm Using Texas Instruments Ba Ii Finance Train

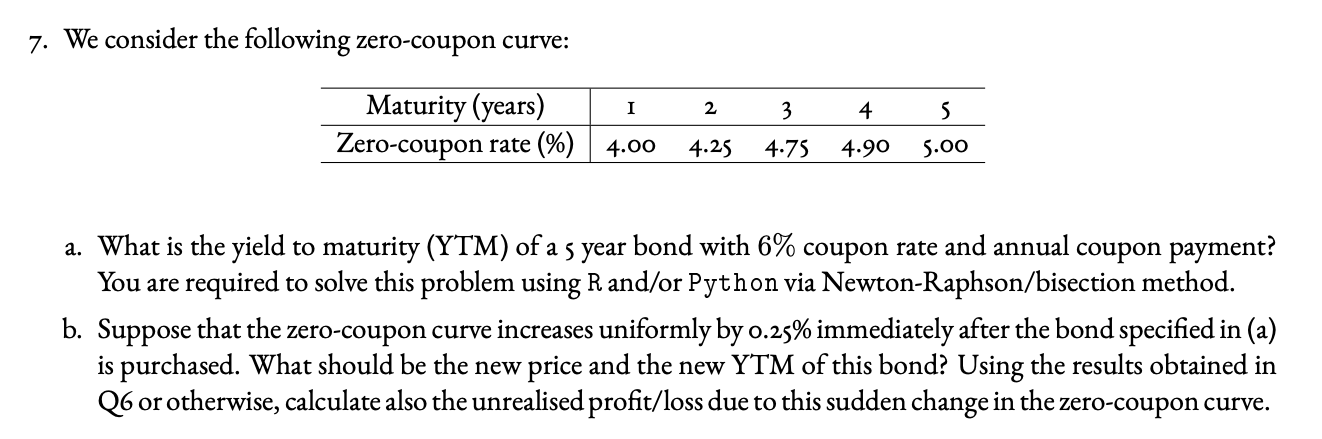

7 We Consider The Following Zero Coupon Curve I Chegg Com

In this introductory lecture, we explain the conceptual framework behind 'Yield To Maturity' and why it is conceptually different from 'Flat Yield'In the neThe coupon rate is equalThe yield to maturity (YTM) measures the interest rate, as implied by the bond, that takes into account the present value of all the future coupon payments and the principal It is assumed that bond holders can invest received coupons at the YTM rate until the maturity of the bond;

Calculating The Yield To Maturity Mastering Python For Finance

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Par Yield Curve Definition

I am trying to calculate the yield to maturity for bonds (working in Google Colab (Jupyter)) The mathematical formulation of the problem is with price = $, number of periods = 60 05 years = 30 years, payment per period = $40 and final payment(par value) = $1000 and interest rate = r Where I am trying to derive the "r" through aPython class and jupyter iPython notebook for pricing a fixed coupon bond bond yield maturity bonds bondyield bondpricingrelativevalue bondpricing yieldestimation bondmaturity currentyield bondcurrentyield bondytm bondyieldto This is an example of a program that creates a binomial tree to calculate the prices of a standardLet's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown below

How To Calculate Yield To Maturity With Python By Gennadii Turutin Medium

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

The dollar amounts should be floatsThe yield to maturity (YTM) measures the interest rate, as implied by the bond, which takes into account the present value of all the future coupon payments and the principal It is assumed that bond holders can invest received coupons at the YTM rate until the maturity of the bond;Bond's Face Value is 1000;

Calculating Weighted Average Cost Of Capital Wacc With Python

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Bond matures in 9 yearsI am using QuantLib in Python to estimate yield curves using the NelsonSiegelSvensson (NSS) model with zerorates as input Since the NSS model in QuantLib uses the discount function to estimate the parameters I simply use the zerorates as bonds with no interestrateThe maturity is , 25, so this is approximately a 10 year bond, right?

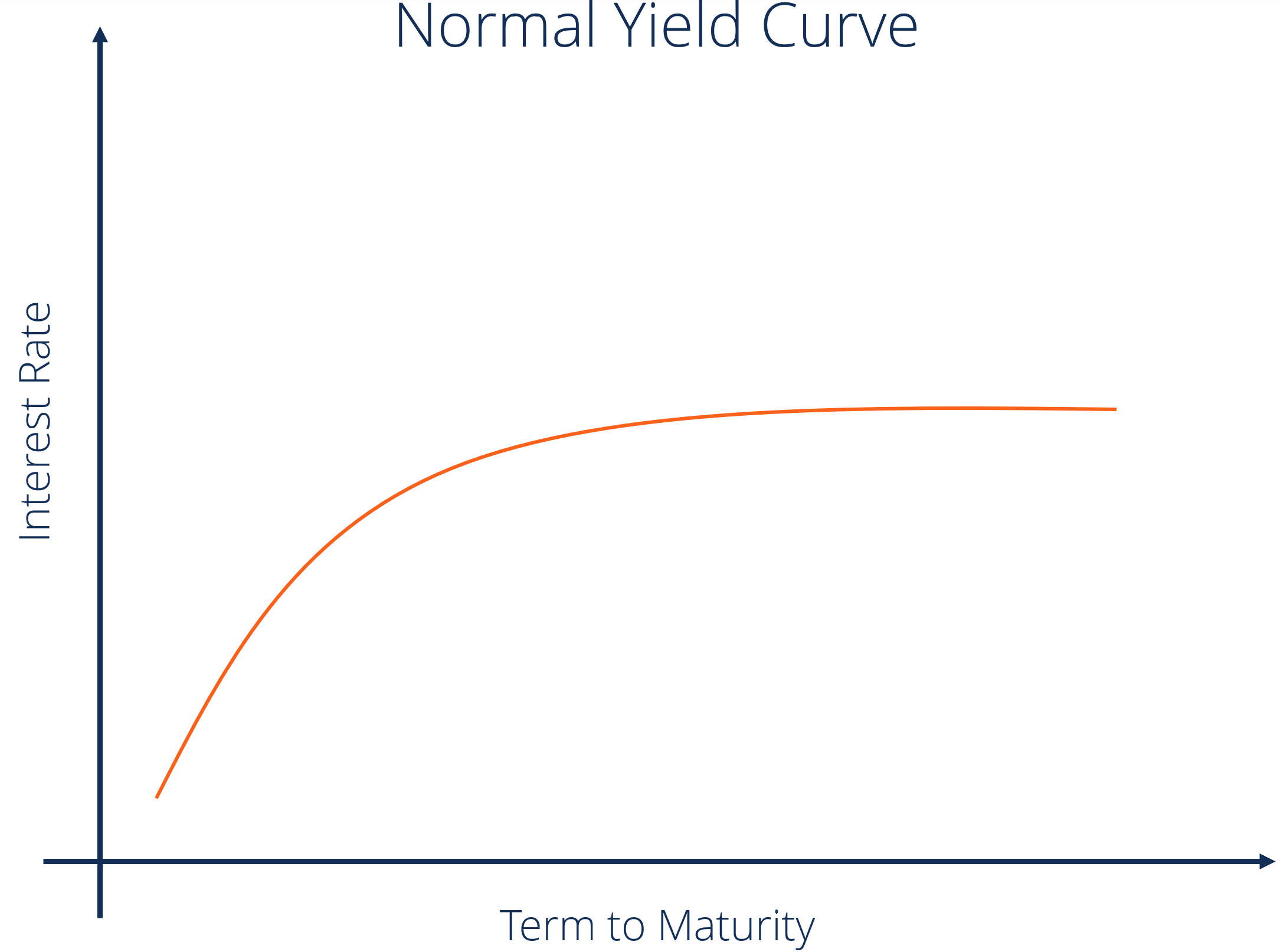

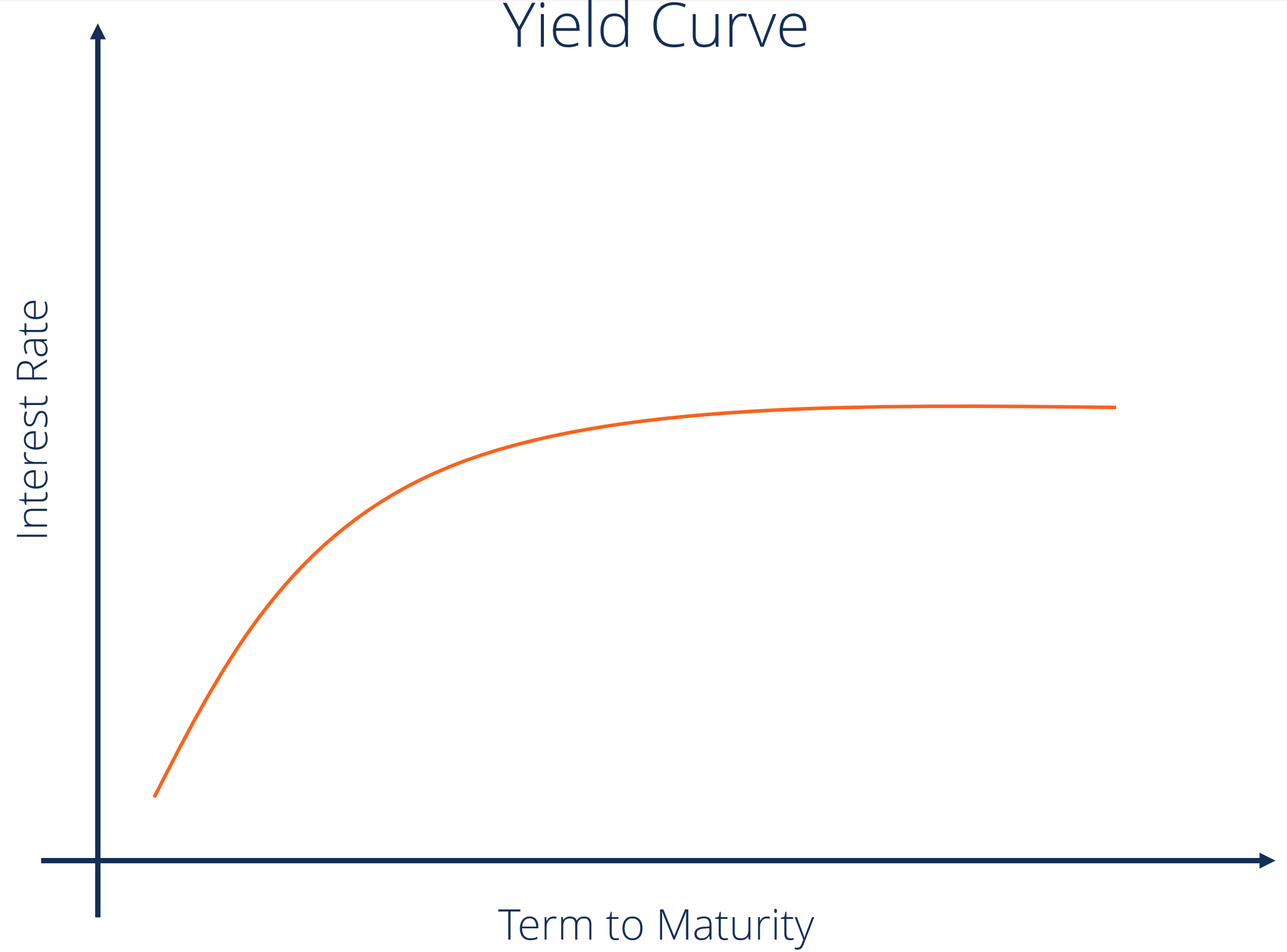

Yield Curve Definition Diagrams Types Of Yield Curves

Valuing A Zero Coupon Bond Mastering Python For Finance Second Edition

N = number of semiannual periods left to maturity;Yield to maturity (YTM) is 8%;What is the Bond price?

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Calculating Bond Index Prices Analyzing The Bond Bear Market

I get a couple of different errors including the missing rparen on your first input line but not the one you cite In any case, you need to cast your input values from str to int and float, as needed Egbert has them almost correct;Bond matures in 9 years;

Www Palmislandtraders Com Econ136 Mpff Pdf

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Bond Github Topics Github

Explore Deep Learning A Tensorflow Python Tutorial Toptal

Compute Bond Price With Zero Spot Rate Curve Using Ti Baii Finance Train

Expected Exposure And Pfe Simulation With Quantlib And Python Jupyter Notebooks A Swiss Army Knife For Quants

Coupon Rate Template Free Excel Template Download

Yield Function Formula Examples Calculate Yield In Excel

Simulating A Bond Fund In Python Part 2 By Erevn Medium

Calculating The Yield To Maturity Mastering Python For Finance Second Edition

Discount Yield Overview How To Calculate Usage

Tool To Calculate Bond Duration Using Python Exploring Finance

Yield To Maturity Formula Harbourfront Technologies

Zero Coupon Bond Yield Formula With Calculator

Cost Of Debt How To Calculate The Cost Of Debt For A Company

Solved Write Python Program Question One Measure Bond S Performance Yield Maturity Ytm Ytm Value Q

Tool To Calculate The Bond Price Using Python Exploring Finance

Parametric Yield Curve Fitting To Bond Prices The Nelson Siegel Svensson Method Resources

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

X2 We Consider The Following Zero Coupon Curve A Chegg Com

Quant Bonds Between Coupon Dates

Q Tbn And9gctpp Yhakt6zldckkc4thylaemc1itl Zuuhu5g Pgc4 Aobhyf Usqp Cau

Modeling Interest Rates And Derivatives

Yield To Maturity Calculator Bond Yield Calculator

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Calculating The Yield Of A Security That Pays Periodic Interest Yield

Gabi Balji Liene Dudele Sanda Medniece Ppt Download

Modeling Interest Rates And Derivatives

Question 2 Use Python For This Entire Question Yo Chegg Com

Price Function Formula Examples How To Price A Bond

Forward Rates Mastering Python For Finance Second Edition

Yield To Maturity Python

Calculating The Annual Yield Of A Security That Pays Interest At Maturity Yieldmat

Zcs1 Stazlb8im

Tool To Calculate The Bond Price Using Python Exploring Finance

How To Calculate Yield To Maturity With Python By Gennadii Turutin Medium

Yield Curve Definition Diagrams Types Of Yield Curves

The Power Of Scala A Bond Calculator With Just 39 Lines Of Code

Yield Curve Demo In Python Youtube

100 Off Fixed Income In Python Smartybro

Implementation Of Bisection Technique To Estimate Yield To Maturity Of Bond Youtube

How To Calculate Forward Rate With Python The Startup

Bonds And Fixed Income Mathematics

Applying Pca To The Yield Curve The Hard Way By Nathan Thomas Towards Data Science

How To Calculate Yield To Maturity With Python By Gennadii Turutin Medium

Www Uio No Studier Emner Matnat Ifi Inf1100 H15 Ressurser Inf1100 Exercises 4th Ed Pdf

How To Calculate Yield To Maturity With Python By Gennadii Turutin Medium

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Yield To Maturity Ytm Overview Formula And Importance

Cost Of Debt Calculator Download Free Excel Template

Tool To Calculate Bond Duration Using Python Exploring Finance

Seminars In Analytical Finance I

Yield Curves Mastering Python For Finance

Quantitative Financial Treasury Yield Curve Bootstrapping

Yield To Maturity Ytm Overview Formula And Importance

Mduration Calculate The Duration Of A Security Using The Macaulay Method

Read Quantlib Python Cookbook Leanpub

Generating A Yield Curve With The Nelson Siegel Svensson Method Excel Library Video 000 Youtube

Coupon Rate Learn How Coupon Rate Affects Bond Pricing

Calculating Weighted Average Cost Of Capital Wacc With Python

7 We Consider The Following Zero Coupon Curve I Chegg Com

Calculating Bond Index Prices Analyzing The Bond Bear Market

Yield To Maturity Ytm Calculator

Infinite Loops In Python Definition Examples Video Lesson Transcript Study Com

コメント

コメントを投稿